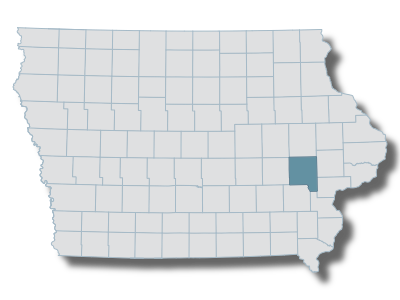

iowa homestead tax credit johnson county

Iowa Ag Land Credit. Adopted and Filed Rules.

Does Iowa Have A Tax Reduction For Seniors Seniorcare2share

The homestead tax credit is a small tax break for homeowners on their primary residenceif you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessors siteyoull need to scroll down to find the link for the homestead tax credit application.

. To be eligible the property owner must occupy the property for at least 6 months of each year including July 1st each year. Youll need to scroll down to find the link for the Homestead Tax Credit Application. The Program is part of the Homestead Tax Credit in the Iowa Code.

If you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessors site. The Homestead Tax Credit is a small tax break for homeowners on their primary residence. 227 s 6th.

Must own and occupy the property as a homestead on July 1 of each year declare residency in Iowa for income tax purposes and occupy the property for at least six months each year. Homestead Tax Credit Application 54-028. Learn More opens in a new tab Demo Videos opens in a new tab Register for Webinars opens in a new tab Like us on Facebook opens in a new tab.

To apply for either the Military Exemption or the Homestead Tax Credit all you need to do is print off the forms from the Johnson County website and either mail or drop them off at the Johnson County Assessors Office 913 S. Johnson County Assessor 913 S Dubuque St. Iowa Property Tax Board of Review Forms.

Iowa City IA 52240 The Homestead Credit is available to all homeowners who own and occupy the residence. Iowa Department of Revenue Tax ApplicationsForms. If you owned another home prior to this please notify us of the address so we can remove the credit.

Homestead Tax Credit Code of Iowa Chapter 425 Any property owner who is a resident of the State of Iowa may receive a Homestead Tax Credit. Report Fraud. This credit was established to partially offset the school tax burden borne by agricultural real estate.

This credit may be claimed by any 100 disabled veteran of any military forces of the United States. You must print sign and mail this application to. Disabled Veterans Homestead Application - 54-049a.

Current law allows a credit for any general school fund tax in excess of 540 per 1000 of assessed value. Homeowners qualify for a property tax credit while renters qualify for reimbursement of the portion of. The current credit is equal to the actual tax levy on the first 4850 of actual value.

Military Service Tax Exemption Application 54-146. Iowa Disabled Veteran Homestead Credit. All land used for agricultural or horticultural purposes in tracts of 10 acres or more and land of less than 10 acres if.

Homestead Tax Credit Application 54-028. The Veterans DD214 papers must be recorded with the Recorder and a current copy of the benefits paid letter showing the. If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site.

Tax credit to a disabled veteran with a service related disability of 100. Instructions for Homestead Application. Originally adopted to encourage home ownership through property tax relief.

What is the Credit. All in all the homestead tax credit usually results in a benefit of a couple hundred dollars but if it is available to you apply for it. It is a tax credit funded by the State of Iowa for qualifying homeowners and is based on the first 4850 of actual value of the homestead.

Iowa Homestead Tax Credit Johnson County Dubuque st suite 217 iowa city iowa 52240. The Homestead Credit is available to all homeowners who own and occupy the. The military tax credit is an exemption intended to provide tax relief to military veterans who 1 served on active duty and were honorably discharged or 2 members of reserve forces or iowa national guard who served at least 20 years qualify for this exemption.

Stay informed subscribe to receive updates. The property owner must be a resident of Iowa pay Iowa income tax and occupy the property on July 1 and for at least six months of every year. Instructions for Homestead Application.

It is a onetime only sign up as long as you occupy the home. It is a onetime only sign up and is valid for as long as you own and occupy the home. Program provides 1certain low-income citizens with property tax assistance.

913 S Dubuque St. The Homestead Credit is calculated by dividing the homestead credit value by 1000 and. The homestead credit is a property tax credit for residents of the state of Iowa who own and occupy their homestead on July 1 and for at least six months of the calendar year.

There are additional benefits attributed to a persons homestead such as the statutory prohibition for some types of judgments to not attach to a persons homestead Iowa Code 62423. Iowa Tax Reform. The homestead credit is a property tax credit for residents of the state of iowa who own and occupy their homestead on july 1 and for at least six months of the calendar year.

The Homestead Tax Credit is a small tax break for homeowners on their primary residenceIf you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors SiteYoull need to scroll down to find the link for the Homestead Tax Credit Application. Business Property Tax Application Form - 54-024a 030617 Business Property Tax Credit Information.

Does Iowa Have A Tax Reduction For Seniors Seniorcare2share

List Of Johnson County Services And How To Reach Them Remotely Kgan

Military Veteran Families Work Life Resources

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

List Of Johnson County Services And How To Reach Them Remotely Kgan

Johnson County Treasurer Iowa Tax And Tags

Johnson County Treasurer Iowa Tax And Tags

Claiming Your Homestead Credit Bankers Trust Education Center

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube